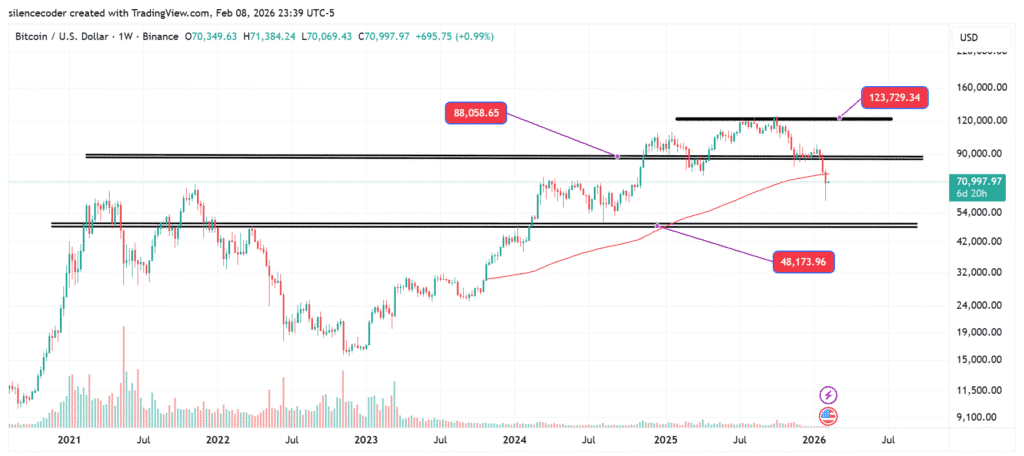

Weekly Chart==>

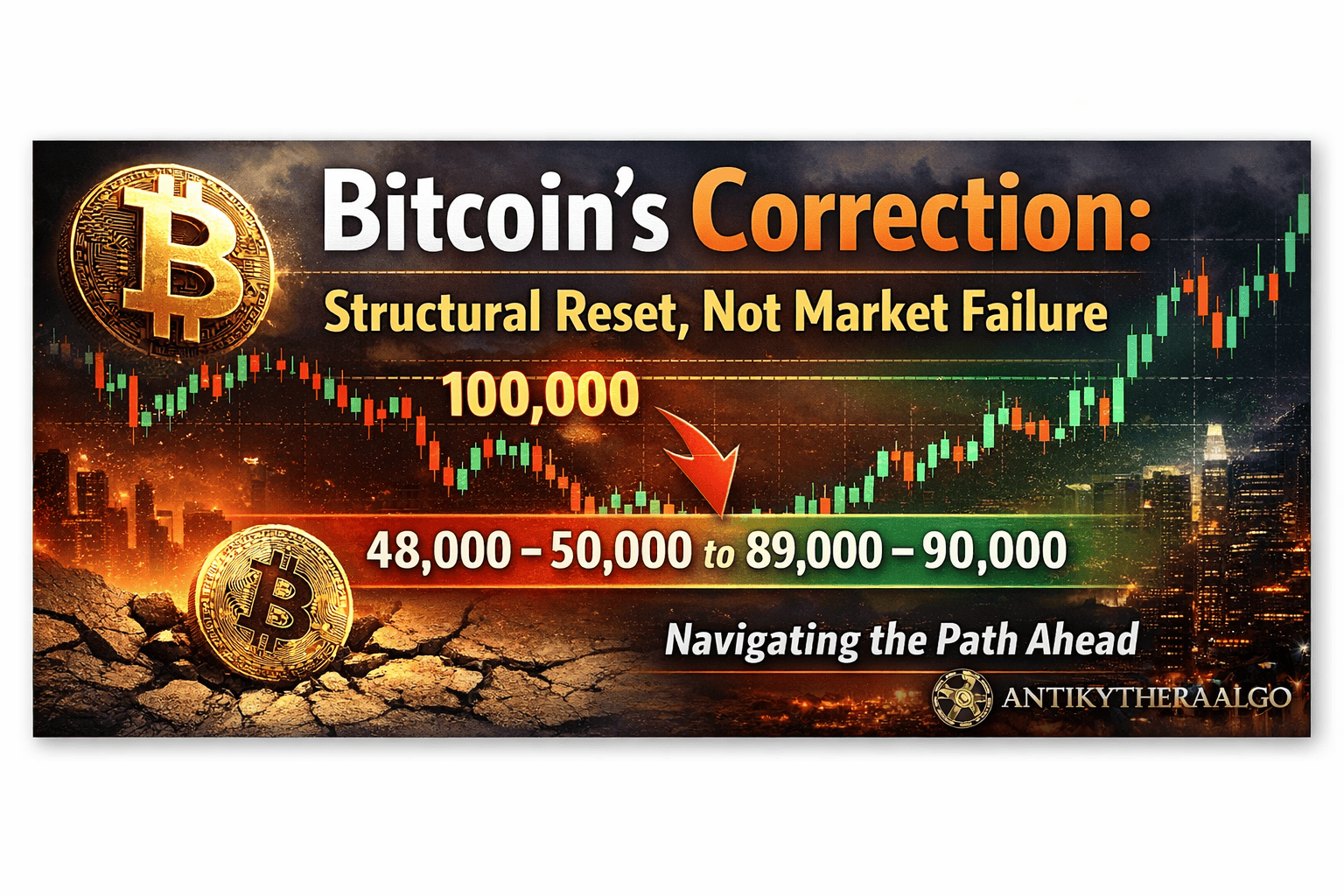

Bitcoin’s Correction: Structural Reset, Not Market Failure

Bitcoin’s recent decline from its higher high is often misinterpreted as a sign of weakness. In reality, the market did not fail because price moved up—it failed because Bitcoin could not hold above the 100,000 level.

Had Bitcoin consolidated above 100,000, even a 20% pullback would have represented a normal and healthy correction. Instead, the level acted as a powerful psychological barrier. Once price broke below it and failed to hold during a retest, deeper downside became increasingly probable.

This scenario was already highlighted in my January 20 cautionary outlook.

A Likely Trading Range Ahead

Based on current structure, Bitcoin is likely to spend a significant period fluctuating between:

48,000–50,000 (support zone)

89,000–90,000 (resistance zone)

The critical variable is how long Bitcoin can remain trapped within this wide range.

What History Suggests

Past cycles offer important clues:

- Major highs in March and October 2021

- Major lows in October and December 2022

- A correction phase lasting roughly one year

Applying this historical framework, the present correction may require 10–14 months to complete. After stabilization, Bitcoin could then need an additional 6–8 months to reclaim and exceed its previous all-time high.

Macro factors—especially CRUDE OIL prices and impact on global liquidity—may influence this timeline. Greater clarity should emerge over the next 3–4 months.

Should Traders Step Aside?

Not at all.

Range-bound markets often provide some of the best trading opportunities. With disciplined execution, traders can grow both capital and portfolio size during these phases.

However, success requires:

- Higher-timeframe analysis

- Strict position sizing

- Consistent stop-loss usage

- Patience for high-quality setups

- Avoidance of overtrading and false breakouts

- Alignment with momentum

Final Thought

This phase is not designed to reward impatience.

It is designed to reward discipline.

Those who master this environment will be best positioned to capitalize when Bitcoin eventually transitions into its next major expansion.

Wait for asymmetry.

Hunt only premium setups.

Exploit volatility.

SOMESH NANDY